ETH Price Prediction: Navigating the Path to $5,000 Amid Institutional Crosscurrents

#ETH

- Technical Momentum Building: ETH trading above 20-day MA with improving MACD suggests underlying strength despite recent pullbacks

- Institutional Dichotomy: Simultaneous ETF accumulation and outflows create mixed signals, requiring clarity in institutional direction

- Fundamental Developments: ERC-8004 AI integration and cross-chain expansion provide long-term bullish catalysts amid short-term volatility

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Resistance

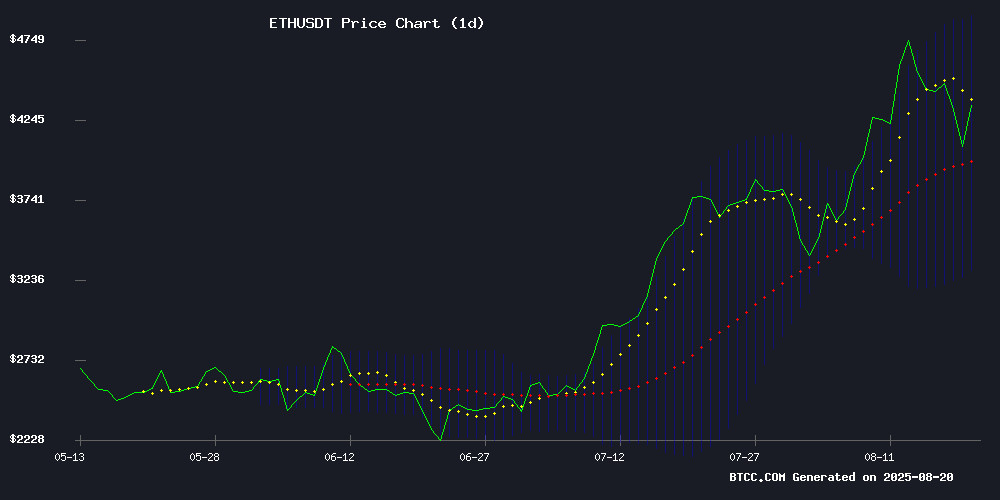

ETH is currently trading at $4,171.57, hovering above its 20-day moving average of $4,091.50, indicating potential short-term support. The MACD reading of -413.62 remains in negative territory but shows improving momentum with a narrowing histogram. Bollinger Bands suggest consolidation between $3,295.38 and $4,887.62, with the middle band at $4,091.50 acting as immediate support.

According to BTCC financial analyst William, 'The technical setup suggests ETH is testing crucial resistance levels. A sustained break above $4,200 could open the path toward $4,500, while failure to hold $4,000 may trigger a retest of lower support zones.'

Market Sentiment: Institutional Divergence Creates ETH Uncertainty

Recent developments present a complex picture for Ethereum. While Spot ethereum ETFs have accumulated over 5% of ETH supply, indicating strong institutional interest, simultaneous ETF outflows and institutional selling pressure have pushed prices below $4,200. SharpLink Gaming's substantial $601 million ETH purchase contrasts with broader institutional caution.

BTCC financial analyst William notes, 'The institutional narrative is split between long-term accumulation and short-term profit-taking. Positive developments like ERC-8004's AI integration and Circle's cross-chain USDC expansion provide fundamental support, but near-term price action remains contingent on institutional FLOW patterns.'

Factors Influencing ETH's Price

US Spot Ethereum ETFs Accumulate Over 5% of ETH Supply

U.S.-listed spot Ethereum exchange-traded funds now hold more than 5% of the total ETH supply, signaling growing institutional confidence in the asset. These funds, which simplify exposure for traditional investors, currently custody 6.3 million ETH worth approximately $26.7 billion.

Recent weeks saw dramatic inflows, with $2.85 billion entering the products last week alone. However, Monday marked a reversal with $196.6 million in net outflows—the second-largest single-day withdrawal since launch. This volatility follows an eight-day streak that brought $3.7 billion in fresh capital.

Ethereum Retreats Below $4.2K Amid Institutional Selling Pressure

Ethereum's price fell below $4,200 after failing to sustain momentum near its recent peak of $4,770. The downturn reflects mounting institutional profit-taking, with ETF outflows accelerating over the past week.

Spot ETH ETFs recorded $196.62 million in net exits on August 18, compounding earlier withdrawals of $59.24 million and $639.36 million on preceding days. While intermittent inflows provided temporary support - including a $1.02 billion injection on August 11 - the overall trend reveals weakening institutional appetite.

Market technicians now watch the $3,900 level as critical support. Some analysts interpret the pullback as a consolidation phase before the next upward leg, with ETF flow volatility suggesting institutional repositioning rather than outright abandonment of ETH exposure.

Ethereum Institutional Investment Drives Market Interest Amid Price Dip

Ethereum (ETH) has dipped 3.32% to $4,378, yet institutional inflows suggest unwavering confidence. A $1.62 billion injection—led by Bitmine Immersion’s Tom Lee—highlights strategic accumulation during the pullback. Trading volume remains robust at $103.85 billion, with market capitalization holding at $522.99 billion.

Analysts interpret the price correction as a consolidation phase rather than a reversal. Key support levels are being tested, but maintained institutional participation could catalyze new all-time highs. The market watches for sustained buying pressure to offset short-term volatility.

SharpLink Gaming Expands ETH Treasury Amid Market Volatility

SharpLink Gaming has significantly bolstered its Ethereum reserves, acquiring an additional 143,593 ETH worth $667.42 million. The Nasdaq-listed company, backed by Ethereum co-founder Joseph Lubin, now holds 740,760 ETH valued at approximately $3.2 billion. This aggressive accumulation strategy underscores institutional confidence in Ethereum's long-term value proposition.

The market reaction has been mixed. SBET stock dipped 3% to $19.27 following the announcement, reflecting investor concerns about equity dilution from recent capital raises. Meanwhile, Ethereum's price faced downward pressure, slipping 2% with technical indicators suggesting potential further decline toward $4,000.

SharpLink's treasury strategy continues to intensify, with ETH concentration reaching 94% of holdings. The company reported $84 million remaining in cash reserves for future acquisitions, signaling potential further market impact. This move follows $146.5 million raised through ATM facilities and $390 million via direct offerings in August.

SharpLink Expands ETH Holdings Amid Price Surge, Reports Q2 Loss

SharpLink Gaming has aggressively increased its Ethereum exposure, purchasing 143,593 ETH worth $667.4 million at an average price of $4,648 per token. The company now holds 740,760 ETH valued at $3.2 billion, capitalizing on Ether's rally toward all-time highs.

Nearly all holdings are deployed in Ethereum's proof-of-stake network, generating 1,388 ETH in staking rewards. This strategic accumulation comes despite SharpLink reporting a $103 million Q2 2025 loss, primarily from paper losses on liquid staked ETH positions.

The move reflects growing institutional demand for Ethereum, with ETF inflows reaching $3.7 billion. SharpLink's substantial position demonstrates confidence in ETH's long-term value proposition, even as its stock price fell 13.5% following the earnings report.

Layer-1 Chains Defect to Ethereum as Rollups Maintain Loyalty

Ethereum's rollup-centric roadmap has defied early skepticism, with layer-2 networks showing no signs of peeling away. Contrary to fears that rollups would abandon Ethereum to become sovereign chains, the opposite trend has emerged: independent layer-1 blockchains are migrating to become Ethereum L2s.

Celo and Lisk, once prominent standalone chains, have pivoted to Ethereum integration. Celo, launched in 2020 as a mobile-first payments L1, completed its transition to an OP Stack rollup in March 2025. Lisk, a 2016 project targeting JavaScript developers, followed suit. Both faced the same hurdles plaguing mid-tier L1s—thin liquidity, fragmented ecosystems, and niche user bases.

"It was the right time to return home to Ethereum," said Celo co-founder Rene Reinsberg, citing new infrastructure like rollup-in-a-box solutions. The migration allows chains to retain technical advantages while tapping into Ethereum's network effects. This gravitational pull toward Ethereum underscores its enduring dominance in smart contract platforms.

'Pirate Nation' Ethereum RPG Shuts Down Amid Growing Crypto Gaming Failures

Proof of Play, the developer behind Ethereum-based role-playing game Pirate Nation, announced the game's shutdown in September, citing unsustainable costs and a dwindling player base. The studio will migrate select game components to an arcade app on the Abstract network.

Adam Fern, Proof of Play's co-founder, described the decision as agonizing but necessary, acknowledging Pirate Nation's failure to achieve mainstream traction despite years of development. The closure adds to a string of crypto gaming casualties in 2025, including Deadrop and Nyan Heroes.

While discontinuing the game, Proof of Play maintains its commitment to blockchain infrastructure development. The shutdown highlights persistent challenges in balancing decentralized gaming economics with player acquisition—a recurring theme across failed Web3 gaming ventures.

SharpLink Gaming Makes $601 Million Ethereum Purchase Amid Market Cooling

SharpLink Gaming has significantly bolstered its Ethereum holdings with a $601 million purchase, acquiring 143,593 ETH at an average price of $4,648 between August 10 and August 15. This marks the company's largest single ETH buy in the past month, bringing its total holdings to 740,460 ETH—valued at approximately $3 billion at current prices.

The aggressive accumulation aligns with SharpLink's publicly stated goal of controlling 1% of all circulating Ethereum, a target that would require ownership of over 1.2 million ETH. The move comes as Ethereum prices retreat 5.9% to $4,124 amid broader risk-off sentiment in digital asset markets.

Market observers note the purchase occurred during a period of macroeconomic uncertainty, with inflation concerns weighing on risk assets. Prediction markets currently price a 72% probability that SharpLink will reach its million-ETH milestone by mid-September.

Circle Launches Gateway for Seamless USDC Transfers Across Seven Blockchains

Circle has taken a major step toward unifying stablecoin liquidity with the launch of Gateway, a cross-chain transfer solution for USDC. The platform connects seven major blockchains—Arbitrum, Avalanche, Base, Ethereum, OP Mainnet, Polygon PoS, and Unichain—enabling instant balance synchronization.

Fragmented liquidity across chains has long burdened exchanges with capital inefficiencies and operational complexity. Gateway addresses this by leveraging smart contracts and off-chain attestation to create a single USDC balance accessible across networks. "We’re excited to announce Circle Gateway has arrived on mainnet," the company tweeted, signaling upcoming expansions to additional chains like Arc.

Ethereum's ERC-8004 Standard Paves the Way for AI-Driven Web3 Economy

Ethereum is positioning itself at the forefront of the next wave of Web3 innovation with the introduction of ERC-8004, a groundbreaking standard dubbed 'Trustless Agents.' Spearheaded by Davide Crapis of the Ethereum Foundation, this protocol lays the groundwork for autonomous AI agents to interact, cooperate, and transact without intermediaries. The framework relies on three core components—identity, reputation, and validation—all anchored on Ethereum's blockchain.

The A2A protocol embedded in ERC-8004 enables AI agents to communicate and establish trust automatically, heralding the dawn of a 'machine economy.' Backed by heavyweights like the Linux Foundation, Google, and Nethermind, this initiative underscores Ethereum's methodical approach to innovation—eschewing hype for deliberate, consultative development.

Binji's vision of an 'incorruptible foundation' for autonomous agents aligns with Ethereum's broader ambition to redefine trust in digital ecosystems. As the line between AI and blockchain blurs, ERC-8004 could become the bedrock of a new era where machines negotiate, collaborate, and thrive in a decentralized landscape.

Ethereum ETF Outflows Signal Institutional Caution as ETH Price Dips

Ethereum faces mounting pressure after $109 million fled U.S. spot ETFs, dragging its price below key support levels. The cryptocurrency now hovers near $4,200 as order book imbalances and weakening technicals compound bearish sentiment.

Institutional appetite appears to be cooling rapidly - a stark reversal from earlier ETF-driven enthusiasm. Large investors typically lead such capital flight when near-term conviction wanes, though Ethereum's long-term adoption thesis remains intact.

Chart patterns suggest critical technical support lies at $4,000. A breach could accelerate declines, while holding may establish a base for recovery. Market makers currently show limited buy-side interest at current levels.

Will ETH Price Hit 5000?

Based on current technical and fundamental analysis, reaching $5,000 represents a significant challenge that requires multiple catalysts aligning. The current price of $4,171.57 would need approximately 20% appreciation to achieve this milestone.

| Key Levels | Price | Significance |

|---|---|---|

| Current Price | $4,171.57 | Testing resistance |

| Immediate Resistance | $4,500 | First major hurdle |

| Target Level | $5,000 | 20% appreciation needed |

| Strong Support | $4,000 | Critical holding level |

BTCC financial analyst William suggests, 'While $5,000 is achievable in the medium term, it requires sustained institutional inflows, resolution of current selling pressure, and broader market momentum. The technical structure shows potential, but fundamental catalysts must materialize to drive this move.'